With the rise in internet-based devices and the rapid growth of the ‘Internet of Things’ leading to a demand for IPv4 addresses which is outpacing supply, there is an advocacy for increased adoption of a new internet protocol (IPv6) designed to mitigate the inherent shortage of finite IPv4 addresses. At some point a tipping point will be reached.

We delve into the latest market trends, expert analyses, and strategic insights that are shaping the future of IPv4 with Linda Shannon.

How would you say the IPv4 market has changed since you started?

The IPv4 address market centred on the monetisation of IP addresses (the numbers that connect devices to the Internet) has changed dramatically since I joined Hilco. The prospect of an organisation making millions from the sale of the rights to IP addresses is still met with scepticism, but there is growing awareness IP addresses have value. They are akin to a commodity and can be sold on the secondary market. At current pricing of $30 to $50 per IP address – up from $5 per address at the beginning of the market about twelve years ago – this value is significant. The smallest transferable IPv4 block size is now worth five figures and, with a common size of legacy allocation being 65,536 IP addresses, returns run into the seven figures.

My New York-based counterparts at IPv4.Global describe a Wild West environment in the early years of the market’s inception when a “black market” operated. This was before the world’s regional internet registries altered their transfer policies in recognition of the need to better facilitate the re-distribution of increasingly scarce IP address resources (there are a finite number at approximately. 4.3 billion addresses). Horror stories of fraud and sellers transferring IPv4 addresses only to never receive the funds are told. Plus, brokers were initially met with some hostility by Internet evangelists. The secondary market (which Hilco helped create) is now legitimate and viewed positively. Hilco has brought professionalism and transparency to this marketplace by publishing all our pricing data. Certain registries now operate qualified facilitator programmes to vet advisors.

A more recent development in the IPv4 market has been the emergence of a leasing market which is still maturing. Internet Service Provider Cogent’s recent offering of $206m secured notes, secured by certain of Cogent’s IPv4 addresses and related customer IPv4 address leases, is a first-of-its kind securitisation of IPv4 address assets.

Have you noticed a difference in buyer and seller trends in the current financial climate?

We are receiving more enquiries from holders of unused or underutilised IPv4 addresses in certain challenged sectors such as higher education and local government. Given the financial pressures currently facing higher education and public sector institutions, renumbering their networks to gain efficiencies and free up their large continuous blocks of IP address assets (which were historically allocated to them free-of-charge and rarely appear on the Balance Sheet) for sale is seen as attractive and certainly worth the short term “pain”.

Insolvency practitioners are also paying greater regard to the potential existence of IP address assets in their caseload. Hilco recently helped an insolvency practitioner receive a $2m settlement for creditors in relation to a historical transfer of IP addresses at undervalue. We have advised on creative sales strategies such as a dual sales strategy and carve-out of IPv4 addresses from a sale of the business and assets of a distressed telecoms provider, resulting in a significant increase in the level of the overall return.

Buyers whose cash flow and budgets are constrained in the current financial climate are increasingly turning to leasing as opposed to an outright purchase as a good option.

With us surpassing four years since lockdown, would you say sector trends have reverted to pre-covid, remained the same or have changed to match the post-covid world?

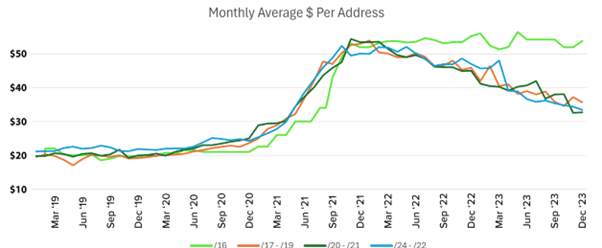

The value of IP addresses more than doubled over the course of the pandemic. This large jump in pricing has since settled down over the last several months, with prices pairing back slightly.

During the past four years IPv4 prices have, overall, risen. These higher prices enticed reluctant sellers into the market, especially as economic stress following the pandemic moved organisations to monetise available assets. At the same time, network operators, aware of the increased value of IPv4 holdings, have focused on efficiency. More efficient networks lead to more unused inventory that is available for sale and reduces the demand for additional address space. We do not anticipate any change in either of these two factors.

Beginning in early 2022, IPv4 address prices have inverted: large blocks are selling for more than smaller ones. Since then, they have also diverged, with the difference between small to mid-size blocks and larger ones becoming significant. The amount per IP address differential is likely greater than the integration cost penalty of dealing with multiple small blocks. For many years (2016 – 2020), larger IPv4 address blocks consistently traded at something of a discount to smaller blocks. Large buyers promoted the idea that they should get a bulk discount for committing to a large purchase. The lower per-IP price of large-block IPv4 addresses ended in late 2021. Large blocks became (relatively) more costly than smaller ones but continued to trade in a tight range. Smaller blocks began to be traded in a wider – and generally lower – range. Today, sellers can expect a higher price-per-address for larger blocks. While some premium for large blocks is reasonable in light of their relative scarcity, the difference in price between small and large blocks appears to be larger than could be expected. The significance – some say irrationality – of the spread is unlikely to persist. We predicted and have started to see the broad price difference between large blocks and all others reduced over the course of this year as prices converge.

Director

Intellectual Property

Glasgow Office

Priya Kapur is a Valuer within Hilco Valuations Services Europe, based in the Birmingham office. Prior to joining Hilco Valuation…

Learn More

With the UK Climate Change Conference of the Parties (or, rather informally “COP26”) being held in Glasgow, Scotland this month,…

Learn More

The restructuring and insolvency sector will be keeping a keen eye on the outcome of the Coronavirus Business Interruption Loan…

Learn More