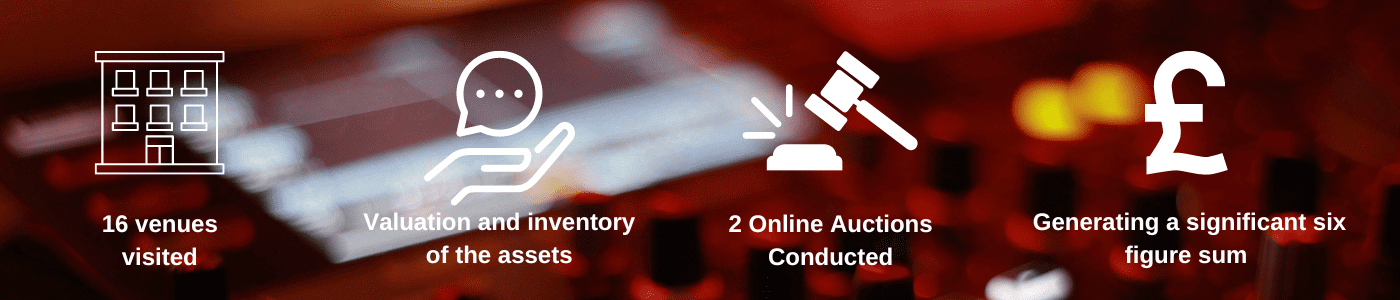

In December 2023, we received instructions to provide valuation and disposal strategy advice in connection with the business assets of Rekom UK Group (Rekom) prior to the appointment of Joint Administrators, Jon Roden, Rob Parker and Helen Dale of Grant Thornton UK LLP. Hilco have assisted and provided valuation advice directly to the Company for several years with frequent site inspections and desktop reviews. In total, Hilco have visited 16 venues altogether, across the Company’s portfolio within the last three years. Formally known as Deltic Group, Rekom was established in late December 2020 following a buy out from a Scandinavian Company.

The Company was the UK arm of the Copenhagen-based hospitality group which operates more than 150 businesses throughout Denmark, Norway and Finland. Rekom held a total of 41 nightclubs and late-night bars as at January 2024 across the United Kingdom. Rekom also owns the brand names of PRZYM and ATIK.

Over the years, the Company had continued to review locations whilst adding in late-night bars to those areas that deemed to be more popular. As a result, the majority of the smaller and less desirable locations had been forced to close, meaning a constant change to their portfolio.

However, as a result of several factors, mainly derived from the COVID pandemic during 2020/21, the cost of living crisis and the higher energy prices, it became clear by late 2023 that the Company was experiencing substantial losses in comparison to prior years. Rekom called in Administrators Grant Thornton UK LLP in January to seek professional insolvency advice.

Prior to the formal appointment, we prepared a review of Rekom by physically visiting a number of locations and undertaking a desktop review on all other locations, based upon available information, reference to Rekom’s fixed asset register and our experience of other venues visited. This was to provide an outline view on the potential recovery values in the event of an Administration.

The majority of the business assets associated with Rekom had been in use for several years and were deemed to be nearing the mid/end of their useful economic life. The Company made comment that they would continually rework assets from closed venues to put into their open venues and retained an inhouse maintenance team to manage this.

The Administrators, following a review of the estate, concluded that 18 venues would need to be closed, of the 18 sites destined for closure, 16 venues were attended and principal assets of value that could be removed from the buildings were uplifted and placed in storage pending a sale. These assets ranged from: Sound equipment, lighting equipment, DJ deck equipment and a range of power amplifiers.

We coordinated site visits and clearances of principal assets across a three day period and brought all equipment to one central location for ease of sale. The quick turnaround implemented by Hilco staff and contractors ensured that all equipment could be scheduled in preparation for an online auction.

We identified that an online auction of all assets would generate the best return and ensured the best net recovery for the administration.

Two online auctions were conducted in February plus a private treaty sale generating a significant six figure sum for the administration process.

For further information on our work with Rekom UK Group or our wider experience in Machinery and Business Assets:

Associate Director

Machinery & Business Assets

Birmingham Office

Managing Director

Machinery & Business Assets

Birmingham Office

Background On 8 June 2023, we received instructions to provide valuation and disposal strategy advice in connection with the machinery…

Learn More

Background Collings Brothers of Abbotsley Ltd, incorporated in December 1955, was an agricultural machinery dealership operating from a freehold property…

Learn More

Background In December 2023, we received instructions to provide valuation and disposal strategy advice in connection with the business assets…

Learn More